English Translated Version

Entrusted by the defendant's relative Zeng Jian (son of Zeng Hanlin), 21 legal experts and law professors from the practice of Criminal Law, Criminal Procedure Law, Evidence Law, Civil Law, Company Law, etc, had a panel discussion on whether defendant Zeng Hanlin guilty of Contract Fraud can be established based on the First Instance Judgement of Chengdu Intermediate People's Court, they debated and put forward their legal opinions. The experts that were invited to attend the panel discussion include: Professor Chen Xing Liang of Peking University, Professor Li Wen Yan of Chinese People's Public Security University, Professor Zhang Si Han of National Judges College, Professor Dan Ming of Supreme People's Procuratorate of the People's Republic of China, Professor Zhou Guo Jun who is Ex-Editor of Law Science Magazine and Professors from China University of Political Science and Law such as Professor Cao Zi Dan, Professor He Bing Song, Professor Pan Chong Yi, Professor Wang Yang, Professor Liu Geng Ju, Professor Qu Xin Jiu, Professor Zhang Ling, Professor Ruan Qi Lin, Professor Li Xian Dong, Professor Wu Xue Song, Professor Yao Xin Hua, Professor Hou Guo Yun, Professor Xu Jiu Sheng, Professor Sui Peng Sheng, Professor Xue Rui Lin, Professor Pei Guang Chuan. Authored by Pei Yu.

The information provided by the Entrustor as follows:

1. A copy of <Statement of Charges>;

2. A copy of <First Instance Judgement>;

3. A copy of <First Instance Defendant Statement>;

4. A copy of <Share Transfer Agreement> on Chengdu Lianyi Industrial Co., Ltd transferring 40% shares to Guangdong Flying Dragon Group;

5. A copy of <Equity Transfer Agreement> on Guangdong High-speed Passenger Ferry transferring 75% equity to Chengdu Lianyi Industrial Co., Ltd;

6. A copy of <Supplemental Agreement>;

7. A copy of Guangdong High-speed Passenger Ferry <Asset Evaluation Report>;

8. A copy of KPMG Certified Public Accounting firm business qualification in China, a copy of <Audit Report> by KPMG Certified Public Accounting firm;

9. A copy of <Account Adjustment Agreement> signed by tripartite parties of Chengdu Lianyi Industrial Co., Ltd., Guangdong Flying Dragon High-speed Passenger Ferry and Guangdong Flying Dragon Group

10. Guangdong Kexin Certified Public Accounting firm presenting a copy each of <Capital Verification Report>, <Asset Evaluation Report>, <Audit Report>, <Foreign-Invested Enterprise Amendment Form>;

11. A copy of Mortgage Contract;

12. A copy of Sanjiu Enterprise <Commitment Letter>;

13. A copy of <Guangzhou Intermediate People's Court reply on related information regarding Zeng Hanlin Contract Fraud>;

14. A copy of schematic diagram of Zeng Hanlin case;

15. A copy of chronological event of Zeng Hanlin case.

Legal opinion from the group of 21 professors unanimously concluded as below:

(1) Confirming the related party transactions behaviour is the key to hearing this case, fulfilling the contract obligation with non-payment method is not illegal Chengdu Lianyi Group sold off the 40% shares from its own subsidiary Chengdu Lianyi Industrial Co. Ltd for a price of RMB 68 million yuan to Guangdong Flying Dragon Group. Both parties signed a "Share Transfer Agreement" on 15 October 1997.

On 25 December 1997, Guangdong High-speed Passenger Ferry under the Guangdong Flying Dragon Groups signed the <Equity Transfer Agreement> with Chengdu Lianyi Industrial Co., Ltd. transferring 75% stake in Guangdong Flying Dragon High-speed Passenger Ferry to Chengdu Lianyi for RMB 74 million yuan.

The signing of the abovementioned two agreements and fulfilment of these two agreements was under the context of Related Party Transaction. According to the Ministry of Finance <Accounting Standards for Enterprises No. 36 - Related Party Disclosures 2006>, "Related Party Transaction describe the behaviour of the transfer of resources, services or obligations between related parties, regardless of whether or not a price is charged", in this case, whether or not a payment is received. The two involved <Equity Transfer Agreement> is the related two parties namely Chengdu Lianyi Group and Guangdong Flying Dragon Group, through related party transactions to realise asset restructuring, changing the scope of business of the listed companies, expansion of business areas to increase economic efficiency.

In the event if Chengdu Lianyi Group was just purely selling off its shares without the injection of high quality assets into the company, not only will that makes the share transfer behaviour meaningless, the two sides can never reach an agreement as well. Related party transactions by mutually holding each other equity in return to realise asset restructuring, the law permits non-payment of such transaction. Related party transactions in this case demonstrate one side holding the other party RMB 68 million yuan worth of equity, while the other side holding opposite party shares worth of RMB 74 million yuan, the price relationship is crystal clear, both parties have the option to offset the amount against each other, no payment is required for such transaction. When Guangdong Flying Dragon Group acquired 40% stake in Chengdu Lianyi Group, it is impossible that they are insolvent and in the state of payment crisis, reason being that the other party owes them RMB 74 million yuan which is higher than the RMB 68 million yuan owed to the other party (Chengdu Lianyi Group).

Related party transactions of both parties mutually holding each other's company shares resulted in the process of Chengdu Lianyi Industrial Co., Ltd. overturn itself from a shell company to a profitable company, this has proven that the associated two equity transfer agreement belongs to related party transactions. Guangdong High-speed Passenger Ferry was given the right to transfer its 75% stake to Chengdu Lianyi Industrial Co., Ltd.

Subsequently, they pumped in their 1997 full-year profit of RMB 32 million yuan into Chengdu Lianyi Industrial Co., Ltd., elevating this empty shell listed companies with its high-quality assets, surging the price per share of Chengdu Lianyi Industrial Co. Ltd from RMB 5.40 yuan to a height of RMB 13.58 yuan, result in Chengdu Lianyi Group benefitting over RMB 200 million yuan worth of shares profit. With the 40% stake acqusition by Guangdong Flying Dragon Group in Chengdu Lianyi Industrial Co., Ltd., this has also generated a 10 get 3 bonus shares scheme that increased the company shares from 34.216 million shares to 54.7456 million shares.

This direct result in economic benefits was the achievement of a successful restructuring of assets under related party transactions; both parties have benefit from it. This is the complete process of related party transactions of asset restructuring. For a fully completed related party transaction, there is no legal basis and obscure for the judiciary to support one party to force the related other party for payments and even using criminal law to investigate the other party for criminal liability. Both parties in the two <Equity Transfer Agreement> has decided to adopt the same method of fulfilling the agreement by payment method. This is decision of both parties individually. In the course of fulfilling the agreement, if there is a breach of contract by one or both parties, they should bear their respective responsibilities for breaching of contract. But to change the fulfilment approach to "no payment" method by either both parties or one party is not illegal. When mutually agree to transfer both parties company shares, the payment method was set forth in the agreement during signing, if both parties had neither perform or fully perform their obligation of the agreement, it will inevitably result in contradiction. However, this is a contract dispute, not a crime. This breach of contract relates only to the conflict of interests between both parties, it is not a threat to the society. Any dispute can be settled through a court proceeding, the Public Security Authority should not intervene.

Between June to July 1999, Sanjiu Enterprise Group, Guangdong Flying Dragon Group, Chengdu Lianyi Group reached an agreement, Sanjiu Enterprise Group will acquire Chengdu Lianyi Industrial Co. Ltd 54.7456 million shares that originally belongs to Guangdong Flying Dragon Group for an amount of RMB 85 million yuan. In the end, due to lack of fund by Sanjiu Enterprise Group, this related party transactions was eventually shelved.

In the event of Chengdu Lianyi Group fulfilling the Equity Transfer Agreement, if knowing that Guangdong Flying Dragon Group Assistant General Manager Zhang Zhaohui had produced "fake" certificate of deposit and remittance statement on 10 and 12 December 1997, which they still proceed to sign the second <Equity Transfer Agreement> on 25 December 1997, this has proven that the two equity transfer agreement is a part of the related party transactions, it also show that the both parties are encounter difficulties in monetary payment to each other to fulfil the contract, therefore using the equity transfer method to offset the equity price against each other, reaching a mutual acceptable consensus. Otherwise it is impossible to sign the second <Equity Transfer Agreement>. Both two <Equity Transfer Agreement> have agreed to use the monetary payment method to perform the contract obligation to each other, but both parties have no funds to pay to each other, the only way to move forward is by using the equity price offsetting method, which is also to reach the desired protection for this related party transactions. Chengdu Lianyi Group is confident they are adequately safeguards protected, thereby participated in this related party transactions, they are not being duped to participate.

Determining that the related party transactions exist between Chengdu Lianyi Group and Guangdong Flying Dragon Group is an evidence of fact. In the 1997 annual report of Chengdu Lianyi Industrial Co., Ltd., under the Section 5, Clause 1, Item 4 of significant association matters reporting stated that: "Our largest shareholder Guangdong Flying Dragon Group is the transferor and parent company of Guangdong High-speed Passenger Ferry. This equity transfer activity is a related party transaction." "Guangdong Foreign Economic Law Office has issued a legal opinion of this related party translation that it legal and valid."

In the annual report of 1997, 1998 and interim report of 1999 reporting on Chengdu Lianyi Industrial Co. Ltd's company performance, it had reported positively on the 40% Chengdu Lianyi Industrial Co. Ltd equity held by Guangdong Dragon Flying Group and the 75% Guangdong High-speed Passenger Ferry equity held by Chengdu Lianyi Industrial Co., Ltd. as asset restructuring, since it is a part of the reorganization of assets, it must be related party transaction.

The process of fulfilling the two equity transfer agreement is also defined as related party transaction. Guangdong Flying Dragon Group had made an immediate deposit payment of RMB 2 million yuan to the other party upon signing the second equity transfer agreement on 25 December 1997. This indicates that the fulfilment of the first agreement was the pretext of signing the second agreement, this has also demonstrated the obligation fulfilment of these two agreements and the contracts are associated to each other right from the beginning.

(2) The RMB 74 million yuan equity price is enough to demonstrate that Zeng Hanlin is innocence; the basic fact cannot be vacillated

Guangdong High-speed Passenger Ferry transfer its own 75% equity worth RMB 74 million yuan to Chengdu Lianyi Industrial Co., Ltd., this process does not constitute fraud behaviour:

In the FIRST section of the related party transaction, the Guangdong Branch (98) No. 011 <Audit Report> presented by Guangdong Kexing Certified Public Accountants and the registration information with Administration for Industry and Commerce have proven that during the registration of subsidiary company Guangdong Flying Dragon High-speed Passenger Ferry, Zeng Hanlin's Guangdong High-speed Passenger Ferry had already invested RMB 75 million yuan in it, holding a 75% stake, there is no doubt on this fact. In the process of Guangdong High-speed Passenger Ferry applying as a Chinese-Foreign Equity Joint Venture Company, the documents approved by the Foreign Economic and Trade indicated China counterpart equity as 51%. This is just a policy approval, which means that the China counterpart must be holding not less than 51% stake in this Joint Venture but not limiting to only 51%. According to the provision of Company Law, the equity of the investor in the company is determined by the registered capital invested by the investor.

Guangdong High-speed Passenger Ferry holds a 75% stake in Guangdong Flying Dragon High-speed Passenger Ferry, the offered price of RMB 74 million yuan by them is higher than the RMB 68 million yuan, an intention to cheat the other party's possession will not occur. This was also clearly reported in the 1998 annual report of Chengdu Lianyi Industrial Co. Ltd under Page 15 Line 18 to Line 20; the company will pay Guangdong High-speed Passenger Ferry RMB 74 million yuan in three instalments between year 1999 to 2002. This is an evidence of fact.

In the SECOND section of the related party transaction, Sanjiu Enterprise Group decided to use RMB 85 million yuan to purchase 54.7456 million shares of Chengdu Lianyi Industrial Co., Ltd. which was originally held by Guangdong Flying Dragon Group control 5474.56 shares.

This matter was proposed and facilitated by Chengdu Lianyi Group till closure. Sanjiu Enterprise Group has put forward a condition that Chengdu Lianyi Group must removed the RMB 74 million yuan debt owed by Chengdu Lianyi Industrial Co., Ltd. to Guangdong High-speed Passenger Ferry from the company's debt. In view of this, Chengdu Lianyi Industrial Co., Ltd., Guangdong Flying Dragon High-speed Passenger Ferry, Guangdong Flying Dragon Group together signed a <Account Adjustment Agreement> in order to prove that the RMB 74 million yuan Chengdu Lianyi Industrial Co., Ltd. owed to Guangdong High-speed Passenger Ferry has been write off in order to remove the relevant obligation of Sanjiu Enterprise Group after the acquisition of shares. <Account Adjustment Agreement> is a document produced to terminate the former related party transactions relationship, it no longer has any direction relationship to the relevant obligation of the original two <Equity Transfer Agreement>.

This <Account Adjustment Agreement> cannot be used as a proof to show that Chengdu Lianyi Industrial Co., Ltd. does not owe the other party the equity amount of RMB 74 million yuan, neither can it be used as a reason for both companies not to swap their shares. As Sanjiu Enterprise Group did not fulfil the contractual obligation on the acquisition of 54.7456 million shares with RMB 85 million yuan, whether the <Account Adjustment Agreement> is true or false is immaterial and has been ineffective. As long as the RMB 74 million yuan stock price still exist, Zeng Hanlin is innocence. It should be noted that the main content of the <Account Adjustment Agreement> is to remove the debt owed by Chengdu Lianyi Industrial Co. Ltd to Guangdong High-speed Passenger Ferry for the equity transfer in contra with the profit owed by Guangdong Flying Dragon High-speed Passenger Ferry to Chengdu Lianyi Industrial Co. Ltd. From the principle content of the contract, without the RMB 74 million yuan main creditor Guangdong High-speed Passenger Ferry (the original Guangdong High-speed Passenger Ferry is the parent company of Guangdong Flying Dragon High-speed Passenger Ferry) participating in signing the contract, from a debt perspective, after Guangdong Flying Dragon High-speed Passenger Ferry has been acquired by Chengdu Lianyi Industries Co. Ltd, whether its profits should be submitted to the major shareholder Chengdu Lianyi Industrial Co. Ltd, is a matter between Guangdong Flying Dragon High-speed Passenger Ferry and its major shareholder Chengdu Lianyi Industrial Co., Ltd., while the RMB 74 million yuan equity transfer amount is an issue between Chengdu Lianyi Industrial Co., Ltd. and Guangdong High-speed Passenger Ferry. After the 75% stake in Guangdong Flying Dragon High-speed Passenger Ferry has been acquired by Chengdu Lianyi Industrial Co. Ltd, it no longer belongs to Guangdong Flying Dragon Group. These two different debt amounts cannot be contra in this circumstance. This <Account Adjustment Agreement> is therefore not a legally binding agreement and has no legal effect. Ironically, this agreement has becomes the evidence of fact that Chengdu Lianyi Industrial Co., Ltd. do owed Guangdong High-speed Passenger Ferry the equity amount of RMB 74 million yuan, an irrefutable fact.

(3) The error of law used in the First Instance Judgement

In accordance with the provisions of Article No. 224 of the Criminal Law, Contract Fraud refers to whomever during the course of signing or fulfilling a contract, commits the act to defraud money or property of the other party for the purpose of illegal possession. The errors of law used in the First Instance Judgment are as follows:

(i) Subjective conclusion on defendant Zeng Hanlin "having the intention to illegal possess" is totally groundless, has no basis of fact.

The fraud behaviour defined in the First Instance Judgment was base on Zhang Zhaohui fabricating fake certificate of deposit and remittance documents to Chengdu Lianyi Group Co., Ltd., so the purpose of illegal possession was established in this manner, this is illusionary.

The equity transfer involved in this case is a part of the related party transactions, Zeng Hanlin as the associated party in order to allow Guangdong Flying Dragon Group to go through assets restructuring, had paid a hefty sum in this backdoor listing. This proved that he had no intention to illegally possess the property of the other party. Evaluating the price paid by Guangdong Flying Dragon will need to take into consideration of the two contracts. Guangdong Flying Dragon Group injected its subsidiary company, Guangdong Flying Dragon High-speed Passenger Ferry, high quality asset worth more than RMB 100 million yuan into Chengdu Lianyi Industrial Co., Ltd. despite that Chengdu Lianyi Industrial Co. Ltd has not made any payment. Apart from the transfer of 75% stake to Chengdu Lianyi Industrial Co. Ltd, Guangdong Flying Dragon High-speed Passenger Ferry had even thrown in a full year of 1997 annual profit; this profit alone has already worth RMB 32.85 million yuan. An extra payment of RMB 2 million yuan in cash, another RMB 6 million ,all in all, a total of RMB 40.85 million yuan into the profit basket of Chengdu Lianyi Industrial Co. Ltd. As of 17 August 1998 when the Public Security Authority place the case on file for investigation and prosecution, Chengdu Lianyi Industrial Co. Ltd was supposed to pay to Guangdong High-speed Passenger Ferry the equity price of RMB 13 million yuan, but NOT a penny was paid while Guangdong Flying Dragon Group has fulfilled all milestone payment obligation in accordance with the contract clause. Apparently, it does not have the purpose of illegal possession, the facts have proven this.

(ii) Objective conclusion on defendant Zeng Hanlin defrauding the 40% stake in Chengdu Lianyi Industries Co., Ltd is totally illogical. Defining the loan of RMB 35 million yuan as an integral part of the contract fraud has no legal sense.

(a) Transposing the cause and effect, time and relationship, event chronological order that leads to a wrong conclusion. The first instance verdict determined that the defendant Zeng Hanlin fulfil a small part of the contract as a bait, instigating Zhang Zhaohui to fabricate false certificates of deposit, remittance documents and using other means to swindle Chengdu Lianyi Group RMB 68 million yuan worth of corporate shares. This reverse of the event chronological order, time and relationship is completely illogical. When Guangdong Flying Dragon Group acquire the 40% stake in Chengdu Lianyi Co., Ltd., the contract was signed on 15 October 1997. The false certificates of deposit and remittance certificate were issued on 10 December 1997 and 12 December 1997, the payment of the contract deposit of RMB 2 million yuan was done in 26 December 1997. In addition, Guangdong Flying Dragon Group has also paid to Chengdu Lianyi Group an amount of RMB 6 million yuan in September 1998. All these fraudulent pretences determined in the first instance verdict occurred after the signing of the first <Equity Transfer Agreement>. Thus, the recognition of these facts in the first instance verdict has completely reversed the order of the event chronological order, time and relationship, will definitely leads to a wrong conclusion, judgment error by the prosecutore is inevitable.

(b) Using fulfilment of a small part of the contract as a bail to deceive Chengdu Lianyi Group in continuing to honour the contract, this cannot be established. The first instance verdict determined that Guangdong Flying Dragon uses the plot of "fulfilling a small part of the contract as bait to trick Chengdu Lianyi Group in fulfilling the contract, as a matter of fact, this is not just fulfilment of a small part of the contract, but full payment performed periodically to fulfil its obligations by Guangdong Flying Dragon Group. After both parties had signed on the two <Equity Transfer Agreement>, Guangdong Flying Dragon Group has injected its subsidiary Guangdong Flying Dragon High-speed Passenger Ferry's 1997 whole year profit of RMB 32.85 million yuan into Chengdu Lianyi Industrial Co. Ltd, plus cash payments of RMB 8 million yuan, a totalled of RMB 40.85 million yuan. In accordance to the terms and conditions defined in the first <Equity Transfer Agreement>, before the Public Security Authority place the case on file for investigation and prosecution on 17 August 1998, the payment required from Guangdong Flying Dragon Group for the equity price happens to be only RMB 40 million yuan.

(4) Defining the loan of RMB 35 million yuan as an integral part of the contract fraud has no legal sense

The first instance verdict ascertained that "Guangdong Flying Group deceived Chengdu Lianyi Group into signing the Equity Transfer Agreement, and followed with fulfilling only a small part of the contract, producing false certificates of deposit and remittance documents and other means to trick the Chengdu Lianyi Group to continue performing its obligation on the contract, conning Chengdu Lianyi Group RMB 68 million worth of equity, using it as a security pledged for loans and occupying the loan for own use, this behaviour constitute a contract fraud and the defraud amount is extremely huge. Defendant Zeng Hanlin is the Chairman and General Manager of Flying Dragon Group, is the executive with direct responsibilities in the company and is therefore directly responsible for the crime in his unit, this behaviour constitute a crime of contract fraud." From this judgment, the first instance verdict obviously had ascertained the loan of RMB 35 million yuan as an integral part of the contract fraud. Such ascertainment is erroneous.

Firstly, Guangdong Flying Dragon Group did not sign the Equity Transfer Agreement for the loan. Even though Guangdong Flying Dragon Group had uses its 54.7456 million equity in Chengdu Lianyi Industrial Co. Ltd as a security pledged for loans of RMB 35 million but this was not its intention in acquiring the other 40% equity in the first place. The <Equity Transfer Agreement> was signed on 15 October 1997 while the loan of RMB 35 million yuan from Bank of Communications was obtained on 18 August 1998, the before and after of both incidents happened at an interval of 10 months apart. During this period of time, the financial statement from Guangdong Flying Dragon High-speed Passenger Ferry had been merged and consolidated with Chengdu Lianyi Group; its profit has been injected into Chengdu Lianyi Industrial Co., Ltd. as well. To take note, the 75% stake of Guangdong Flying Dragon High-speed Passenger Ferry had now belongs to Chengdu Lianyi Industrial Co. Ltd, although the changes have not been completed in the Administration for Industry & Commerce but the registration of changes had been approved by the SFC. The equity transfer does not consider the changes in the Administration of Industry & Commerce as a necessary element. Occupying the loan will not be the real intention of Guangdong Flying Dragon Group. The loan of RMB 35 million yuan was actually used to repay Guangdong Flying Dragon High-speed Passenger Ferry debts for the purchased of ships, docks, boat as well as for the company operation cost. In addition, there was a RMB 6 million yuan paid to Chengdu Lianyi Group. The distribution and usage of the money clearly illustrated that the real purpose of the loan was to create a multi-win-win situation; this kind of situation cannot be generated immediately during the signing of the Equity Transfer Agreement.

Secondly, identifying the loan amount as "illegal possession" is incorrect. Amount borrowed from the bank has to be returned upon the expiry of the loan terms with its principle amount and interest. The RMB 35 million yuan was put back into the company for use, as long as the interest was paid up, the borrower has the right to possess it. Borrower behaviour in the case of non-infringement of capital ownership, does not exhibit any element of contract fraud, it cannot constitute a crime. In this case, the defendant Zeng Hanlin did not use the whole or any part of the RMB 35 million yuan loan for personal possession, or taken abroad, or for personal splurge, or withhold without return; Guangdong Flying Dragon Group did not default the loan interest payment or exhibit a behaviour of intending not to pay the principle amount plus interest. Henceforth, there is no recognised behaviour of illegal possession or attempt to illegally occupy the RMB 35 million yuan by Guangdong Flying Group.

Therefore, the RMB 35 million yuan loan should not be considered as part of the integral part of the contract fraud.

Thirdly, the indirect fraud cannot be established. Using the defraud Chengdu Lianyi Group 40% equity and determining using the "defraud" 40% equity to pledge as security for the loan of RMB 35 million yuan is indirect fraud and constitute a contract fraud, this analysis cannot be established. There are two reasons to this: Firstly, the precondition is falsify, before Guangdong Flying Dragon Group transfer the 40% equity, no fraud was performed, the 40% equity was not acquired through fraudulent behaviour; Secondly, there is no exclusivity for such inference from the logic, the conclusion is inappropriate.

Fourthly, there is insufficient evidence to establish that Zeng Hanlin had committed contract fraud.

(1) Relevant authority was in accordance with procedures in disclosure of information and had never concealed any information to anyone. KPMG LLP is an accounting firm approved by the Ministry of Finance and China Securities Regulatory Commission, an establishment of Chinese-Foreign cooperative with audit qualification. Guangdong Asset Evaluation Company is a specialized agency of assessment approved by the State-owned Assets Administration Bureau and the China Securities Regulatory Commission to engage in securities business assets evaluation. Documents produced by the three institutions as mentioned above have legal effect. They produce documents to prove the following:

(i) When signing the Equity Transfer Agreement on 15 October 1997, <Audit Report> clearly documented in the 13 vessels collaterals conditions in 1996, 1997 and 1998; this <Audit Report> is an important document that Chengdu Lianyi Group has to peruse;

(ii) Guangdong Asset Evaluation Report issued on 18 December 1997 sets out the year ended 31 December 1996 that Guangdong Flying Dragon High-Speed Passenger Ferry contained a debt of RM 13.9808 million yuan, this document is a must-read document for Chengdu Lianyi Group when they entered into the Equity Transfer Agreement. Moreover, this document is openly published in the annual reports of the listed companies in 1997, there is no intention to conceal information and no one was unaware of this information.

(iii) <Assessment Report> issued by the Guangdong Kexin Certified Public Accounting firm on 18 March 1996 proved that as per the base date of 31 December 1995, Guangdong High-speed Passenger Ferry original face value of its fixed assets was worth a value of RMB 102,630,389 yuan, the evaluation value of assets is worth RMB 95,096,899 yuan, after assessment, the assess value of fixed assets are worth at RMB 100,014,399 yuan, evaluation variance show an increment of 5.17 percent. The capital verification report issued by Guangdong Kexing Certified Public Accounting firm on 3 July 1996 states that: As of 31 December 1995, Guangdong Flying Dragon High-speed Passenger Ferry total assets are worth RMB 107 million yuan, total liabilities of RMB 7.46 million yuan and net assets (equity) at RMB 99.62 million yuan, paid-up capital at RMB 99.6213184 million. These financial figures are the "must read" information when Chengdu Lianyi Group signed the <Equity Transfer Agreement>. This information was never concealed to anyone.

(2) The prosecutor modify the debt owing data right in the court, the previous accusation of hugh debt amount concluding the inability of Guangdong Flying Dragon Group not being able to honour the acquisition payment just fall apart. A total collapsed.

The first instance verdict determines the defendant "concealing the truth of the huge liabilities and inability to pay", but a clear explanation for the "huge debt" was never clearly defined. As per the prosecutor statement in court, in accordance with the confession of the defendant testimony of Li Kai ascertained that the total debt amount of the defendant at that time was RMB 120 million yuan, in accordance with the prosecutor immediate amendment in the court during the first instance trial was reduced to RMB 30 million yuan, in accordance to the Guangdong Assets Evaluation Report, the total liabilities was RMB 13.9808 million yuan, according to the audit report, the net assets was valued at RMB 108.5322 million yuan, regardless of whether the debt amount was RMB 30 million yuan or RMB 13.9808 million yuan, the company can never be in the insolvent state and no ability to pay. The First Instance hearing is based merely on the verbal testimony of Zhang Zhaohui and Li Kai to conclude that Guangdong Flying Dragon Group is in no position to make payment; there is no factual basis to be established. The prosecution judgement on Zhang Zhaohui 11 years ago was based on the precondition that the company debt amounted to RMB 120 million yuan and was in the state of insolvency. After 11 years, a further hearing on 17 November 2011, prosecutors had amended the debt amount in court from RMB 120 million yuan RMB 30 million yuan. This act has proven the testimony of Zhang Zhaohui, Li Kai, etc (Zhang Zhaohui testimony at then proved that the asset amount during the equity transfer of Guangdong Flying Dragon Group to be RMB 50 to 60 million; Li Kai testimony at then prove that during the equity transfer, the liabilities of Guangdong Flying Dragon Group to be RMB 120 million yuan, debt ratio was 200%) are fictitious, the testimony in the original trial at then from Zhang and Li are groundless and cannot be adopted. According to the rules of evidence, documentary evidence of proof are more effectiveness than oral evidence of proof, when two are in conflict, the documentary evidence shall be admissible. Therefore, the court should not recognised Zeng Hanlin as instigating a contract fraud.

(3) Solitary testimony is inadmissible. The First Instance trial produce evidence of false deposit slips, false remittance documents to deceive each other, towards this, Zeng Hanlin has never admitted to this accusation, the trial volume contains only the solitary testimony of Zhang Zhaohui, this is inadmissible.

(4) To force the defendant to bear the legal consequences dereliction of duty by the informants is unjustifiable.

Base solely on the claim of the informants that he is not aware of the RMB 35 million yuan loan from Guangdong Flying Dragon Group to determine the behaviour of defendant pledging the equity for loans of RMB 35 million yuan is a fraudulent act of contract fraud, this is baseless and lack of evidence of fact. In accordance with the provisions of law, to use a public company shares to be pledged as a security for loans, public notice has to be made, the Borrower had already made a public notice to the Shenzhen Stock Exchange in advance. This proved that the borrower Guangdong Flying Dragon Group and its legal representative Zeng Hanlin have no intention to conceal any information from the other party. The informant as the Vice Chairman of a listed company did not do his part to peruse the Exchange publicity documents is a strong case of dereliction of duty. The informant cannot use his dereliction of duty as a reason to seek legal compensation from the other party. Therefore, Zeng Hanlin's borrowing behaviour cannot constitute a contract fraud.

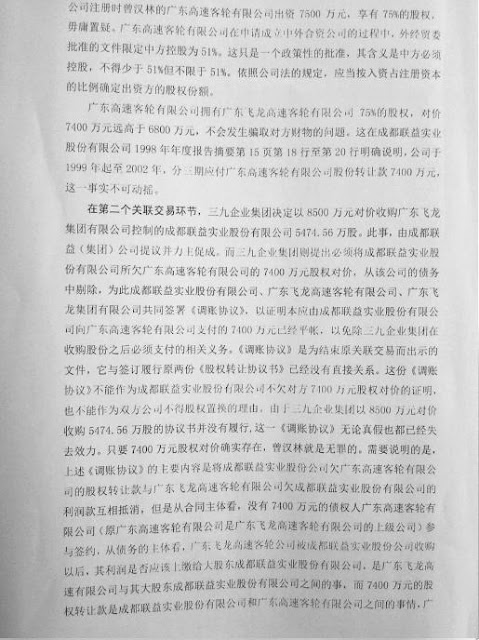

Illustration of the related party relationship between Guangdong Flying Dragon and Chengdu Lianyi:

The 21 Legal Professionals and Law Professors unanimously concluded that Zeng Hanlin is NOT guilty of “Contract Fraud”, it is merely a “Civil Matter”. Their signature as attached:

Legal Opinion (Zeng Hanlin case)

Entrusted by the defendant's relative Zeng Jian (son of Zeng Hanlin), 21 legal experts and law professors from the practice of Criminal Law, Criminal Procedure Law, Evidence Law, Civil Law, Company Law, etc, had a panel discussion on whether defendant Zeng Hanlin guilty of Contract Fraud can be established based on the First Instance Judgement of Chengdu Intermediate People's Court, they debated and put forward their legal opinions. The experts that were invited to attend the panel discussion include: Professor Chen Xing Liang of Peking University, Professor Li Wen Yan of Chinese People's Public Security University, Professor Zhang Si Han of National Judges College, Professor Dan Ming of Supreme People's Procuratorate of the People's Republic of China, Professor Zhou Guo Jun who is Ex-Editor of Law Science Magazine and Professors from China University of Political Science and Law such as Professor Cao Zi Dan, Professor He Bing Song, Professor Pan Chong Yi, Professor Wang Yang, Professor Liu Geng Ju, Professor Qu Xin Jiu, Professor Zhang Ling, Professor Ruan Qi Lin, Professor Li Xian Dong, Professor Wu Xue Song, Professor Yao Xin Hua, Professor Hou Guo Yun, Professor Xu Jiu Sheng, Professor Sui Peng Sheng, Professor Xue Rui Lin, Professor Pei Guang Chuan. Authored by Pei Yu.

The information provided by the Entrustor as follows:

1. A copy of <Statement of Charges>;

2. A copy of <First Instance Judgement>;

3. A copy of <First Instance Defendant Statement>;

4. A copy of <Share Transfer Agreement> on Chengdu Lianyi Industrial Co., Ltd transferring 40% shares to Guangdong Flying Dragon Group;

5. A copy of <Equity Transfer Agreement> on Guangdong High-speed Passenger Ferry transferring 75% equity to Chengdu Lianyi Industrial Co., Ltd;

6. A copy of <Supplemental Agreement>;

7. A copy of Guangdong High-speed Passenger Ferry <Asset Evaluation Report>;

8. A copy of KPMG Certified Public Accounting firm business qualification in China, a copy of <Audit Report> by KPMG Certified Public Accounting firm;

9. A copy of <Account Adjustment Agreement> signed by tripartite parties of Chengdu Lianyi Industrial Co., Ltd., Guangdong Flying Dragon High-speed Passenger Ferry and Guangdong Flying Dragon Group

10. Guangdong Kexin Certified Public Accounting firm presenting a copy each of <Capital Verification Report>, <Asset Evaluation Report>, <Audit Report>, <Foreign-Invested Enterprise Amendment Form>;

11. A copy of Mortgage Contract;

12. A copy of Sanjiu Enterprise <Commitment Letter>;

13. A copy of <Guangzhou Intermediate People's Court reply on related information regarding Zeng Hanlin Contract Fraud>;

14. A copy of schematic diagram of Zeng Hanlin case;

15. A copy of chronological event of Zeng Hanlin case.

Legal opinion from the group of 21 professors unanimously concluded as below:

(1) Confirming the related party transactions behaviour is the key to hearing this case, fulfilling the contract obligation with non-payment method is not illegal Chengdu Lianyi Group sold off the 40% shares from its own subsidiary Chengdu Lianyi Industrial Co. Ltd for a price of RMB 68 million yuan to Guangdong Flying Dragon Group. Both parties signed a "Share Transfer Agreement" on 15 October 1997.

On 25 December 1997, Guangdong High-speed Passenger Ferry under the Guangdong Flying Dragon Groups signed the <Equity Transfer Agreement> with Chengdu Lianyi Industrial Co., Ltd. transferring 75% stake in Guangdong Flying Dragon High-speed Passenger Ferry to Chengdu Lianyi for RMB 74 million yuan.

The signing of the abovementioned two agreements and fulfilment of these two agreements was under the context of Related Party Transaction. According to the Ministry of Finance <Accounting Standards for Enterprises No. 36 - Related Party Disclosures 2006>, "Related Party Transaction describe the behaviour of the transfer of resources, services or obligations between related parties, regardless of whether or not a price is charged", in this case, whether or not a payment is received. The two involved <Equity Transfer Agreement> is the related two parties namely Chengdu Lianyi Group and Guangdong Flying Dragon Group, through related party transactions to realise asset restructuring, changing the scope of business of the listed companies, expansion of business areas to increase economic efficiency.

In the event if Chengdu Lianyi Group was just purely selling off its shares without the injection of high quality assets into the company, not only will that makes the share transfer behaviour meaningless, the two sides can never reach an agreement as well. Related party transactions by mutually holding each other equity in return to realise asset restructuring, the law permits non-payment of such transaction. Related party transactions in this case demonstrate one side holding the other party RMB 68 million yuan worth of equity, while the other side holding opposite party shares worth of RMB 74 million yuan, the price relationship is crystal clear, both parties have the option to offset the amount against each other, no payment is required for such transaction. When Guangdong Flying Dragon Group acquired 40% stake in Chengdu Lianyi Group, it is impossible that they are insolvent and in the state of payment crisis, reason being that the other party owes them RMB 74 million yuan which is higher than the RMB 68 million yuan owed to the other party (Chengdu Lianyi Group).

Related party transactions of both parties mutually holding each other's company shares resulted in the process of Chengdu Lianyi Industrial Co., Ltd. overturn itself from a shell company to a profitable company, this has proven that the associated two equity transfer agreement belongs to related party transactions. Guangdong High-speed Passenger Ferry was given the right to transfer its 75% stake to Chengdu Lianyi Industrial Co., Ltd.

Subsequently, they pumped in their 1997 full-year profit of RMB 32 million yuan into Chengdu Lianyi Industrial Co., Ltd., elevating this empty shell listed companies with its high-quality assets, surging the price per share of Chengdu Lianyi Industrial Co. Ltd from RMB 5.40 yuan to a height of RMB 13.58 yuan, result in Chengdu Lianyi Group benefitting over RMB 200 million yuan worth of shares profit. With the 40% stake acqusition by Guangdong Flying Dragon Group in Chengdu Lianyi Industrial Co., Ltd., this has also generated a 10 get 3 bonus shares scheme that increased the company shares from 34.216 million shares to 54.7456 million shares.

This direct result in economic benefits was the achievement of a successful restructuring of assets under related party transactions; both parties have benefit from it. This is the complete process of related party transactions of asset restructuring. For a fully completed related party transaction, there is no legal basis and obscure for the judiciary to support one party to force the related other party for payments and even using criminal law to investigate the other party for criminal liability. Both parties in the two <Equity Transfer Agreement> has decided to adopt the same method of fulfilling the agreement by payment method. This is decision of both parties individually. In the course of fulfilling the agreement, if there is a breach of contract by one or both parties, they should bear their respective responsibilities for breaching of contract. But to change the fulfilment approach to "no payment" method by either both parties or one party is not illegal. When mutually agree to transfer both parties company shares, the payment method was set forth in the agreement during signing, if both parties had neither perform or fully perform their obligation of the agreement, it will inevitably result in contradiction. However, this is a contract dispute, not a crime. This breach of contract relates only to the conflict of interests between both parties, it is not a threat to the society. Any dispute can be settled through a court proceeding, the Public Security Authority should not intervene.

Between June to July 1999, Sanjiu Enterprise Group, Guangdong Flying Dragon Group, Chengdu Lianyi Group reached an agreement, Sanjiu Enterprise Group will acquire Chengdu Lianyi Industrial Co. Ltd 54.7456 million shares that originally belongs to Guangdong Flying Dragon Group for an amount of RMB 85 million yuan. In the end, due to lack of fund by Sanjiu Enterprise Group, this related party transactions was eventually shelved.

In the event of Chengdu Lianyi Group fulfilling the Equity Transfer Agreement, if knowing that Guangdong Flying Dragon Group Assistant General Manager Zhang Zhaohui had produced "fake" certificate of deposit and remittance statement on 10 and 12 December 1997, which they still proceed to sign the second <Equity Transfer Agreement> on 25 December 1997, this has proven that the two equity transfer agreement is a part of the related party transactions, it also show that the both parties are encounter difficulties in monetary payment to each other to fulfil the contract, therefore using the equity transfer method to offset the equity price against each other, reaching a mutual acceptable consensus. Otherwise it is impossible to sign the second <Equity Transfer Agreement>. Both two <Equity Transfer Agreement> have agreed to use the monetary payment method to perform the contract obligation to each other, but both parties have no funds to pay to each other, the only way to move forward is by using the equity price offsetting method, which is also to reach the desired protection for this related party transactions. Chengdu Lianyi Group is confident they are adequately safeguards protected, thereby participated in this related party transactions, they are not being duped to participate.

Determining that the related party transactions exist between Chengdu Lianyi Group and Guangdong Flying Dragon Group is an evidence of fact. In the 1997 annual report of Chengdu Lianyi Industrial Co., Ltd., under the Section 5, Clause 1, Item 4 of significant association matters reporting stated that: "Our largest shareholder Guangdong Flying Dragon Group is the transferor and parent company of Guangdong High-speed Passenger Ferry. This equity transfer activity is a related party transaction." "Guangdong Foreign Economic Law Office has issued a legal opinion of this related party translation that it legal and valid."

In the annual report of 1997, 1998 and interim report of 1999 reporting on Chengdu Lianyi Industrial Co. Ltd's company performance, it had reported positively on the 40% Chengdu Lianyi Industrial Co. Ltd equity held by Guangdong Dragon Flying Group and the 75% Guangdong High-speed Passenger Ferry equity held by Chengdu Lianyi Industrial Co., Ltd. as asset restructuring, since it is a part of the reorganization of assets, it must be related party transaction.

The process of fulfilling the two equity transfer agreement is also defined as related party transaction. Guangdong Flying Dragon Group had made an immediate deposit payment of RMB 2 million yuan to the other party upon signing the second equity transfer agreement on 25 December 1997. This indicates that the fulfilment of the first agreement was the pretext of signing the second agreement, this has also demonstrated the obligation fulfilment of these two agreements and the contracts are associated to each other right from the beginning.

(2) The RMB 74 million yuan equity price is enough to demonstrate that Zeng Hanlin is innocence; the basic fact cannot be vacillated

Guangdong High-speed Passenger Ferry transfer its own 75% equity worth RMB 74 million yuan to Chengdu Lianyi Industrial Co., Ltd., this process does not constitute fraud behaviour:

In the FIRST section of the related party transaction, the Guangdong Branch (98) No. 011 <Audit Report> presented by Guangdong Kexing Certified Public Accountants and the registration information with Administration for Industry and Commerce have proven that during the registration of subsidiary company Guangdong Flying Dragon High-speed Passenger Ferry, Zeng Hanlin's Guangdong High-speed Passenger Ferry had already invested RMB 75 million yuan in it, holding a 75% stake, there is no doubt on this fact. In the process of Guangdong High-speed Passenger Ferry applying as a Chinese-Foreign Equity Joint Venture Company, the documents approved by the Foreign Economic and Trade indicated China counterpart equity as 51%. This is just a policy approval, which means that the China counterpart must be holding not less than 51% stake in this Joint Venture but not limiting to only 51%. According to the provision of Company Law, the equity of the investor in the company is determined by the registered capital invested by the investor.

Guangdong High-speed Passenger Ferry holds a 75% stake in Guangdong Flying Dragon High-speed Passenger Ferry, the offered price of RMB 74 million yuan by them is higher than the RMB 68 million yuan, an intention to cheat the other party's possession will not occur. This was also clearly reported in the 1998 annual report of Chengdu Lianyi Industrial Co. Ltd under Page 15 Line 18 to Line 20; the company will pay Guangdong High-speed Passenger Ferry RMB 74 million yuan in three instalments between year 1999 to 2002. This is an evidence of fact.

In the SECOND section of the related party transaction, Sanjiu Enterprise Group decided to use RMB 85 million yuan to purchase 54.7456 million shares of Chengdu Lianyi Industrial Co., Ltd. which was originally held by Guangdong Flying Dragon Group control 5474.56 shares.

This matter was proposed and facilitated by Chengdu Lianyi Group till closure. Sanjiu Enterprise Group has put forward a condition that Chengdu Lianyi Group must removed the RMB 74 million yuan debt owed by Chengdu Lianyi Industrial Co., Ltd. to Guangdong High-speed Passenger Ferry from the company's debt. In view of this, Chengdu Lianyi Industrial Co., Ltd., Guangdong Flying Dragon High-speed Passenger Ferry, Guangdong Flying Dragon Group together signed a <Account Adjustment Agreement> in order to prove that the RMB 74 million yuan Chengdu Lianyi Industrial Co., Ltd. owed to Guangdong High-speed Passenger Ferry has been write off in order to remove the relevant obligation of Sanjiu Enterprise Group after the acquisition of shares. <Account Adjustment Agreement> is a document produced to terminate the former related party transactions relationship, it no longer has any direction relationship to the relevant obligation of the original two <Equity Transfer Agreement>.

This <Account Adjustment Agreement> cannot be used as a proof to show that Chengdu Lianyi Industrial Co., Ltd. does not owe the other party the equity amount of RMB 74 million yuan, neither can it be used as a reason for both companies not to swap their shares. As Sanjiu Enterprise Group did not fulfil the contractual obligation on the acquisition of 54.7456 million shares with RMB 85 million yuan, whether the <Account Adjustment Agreement> is true or false is immaterial and has been ineffective. As long as the RMB 74 million yuan stock price still exist, Zeng Hanlin is innocence. It should be noted that the main content of the <Account Adjustment Agreement> is to remove the debt owed by Chengdu Lianyi Industrial Co. Ltd to Guangdong High-speed Passenger Ferry for the equity transfer in contra with the profit owed by Guangdong Flying Dragon High-speed Passenger Ferry to Chengdu Lianyi Industrial Co. Ltd. From the principle content of the contract, without the RMB 74 million yuan main creditor Guangdong High-speed Passenger Ferry (the original Guangdong High-speed Passenger Ferry is the parent company of Guangdong Flying Dragon High-speed Passenger Ferry) participating in signing the contract, from a debt perspective, after Guangdong Flying Dragon High-speed Passenger Ferry has been acquired by Chengdu Lianyi Industries Co. Ltd, whether its profits should be submitted to the major shareholder Chengdu Lianyi Industrial Co. Ltd, is a matter between Guangdong Flying Dragon High-speed Passenger Ferry and its major shareholder Chengdu Lianyi Industrial Co., Ltd., while the RMB 74 million yuan equity transfer amount is an issue between Chengdu Lianyi Industrial Co., Ltd. and Guangdong High-speed Passenger Ferry. After the 75% stake in Guangdong Flying Dragon High-speed Passenger Ferry has been acquired by Chengdu Lianyi Industrial Co. Ltd, it no longer belongs to Guangdong Flying Dragon Group. These two different debt amounts cannot be contra in this circumstance. This <Account Adjustment Agreement> is therefore not a legally binding agreement and has no legal effect. Ironically, this agreement has becomes the evidence of fact that Chengdu Lianyi Industrial Co., Ltd. do owed Guangdong High-speed Passenger Ferry the equity amount of RMB 74 million yuan, an irrefutable fact.

(3) The error of law used in the First Instance Judgement

In accordance with the provisions of Article No. 224 of the Criminal Law, Contract Fraud refers to whomever during the course of signing or fulfilling a contract, commits the act to defraud money or property of the other party for the purpose of illegal possession. The errors of law used in the First Instance Judgment are as follows:

(i) Subjective conclusion on defendant Zeng Hanlin "having the intention to illegal possess" is totally groundless, has no basis of fact.

The fraud behaviour defined in the First Instance Judgment was base on Zhang Zhaohui fabricating fake certificate of deposit and remittance documents to Chengdu Lianyi Group Co., Ltd., so the purpose of illegal possession was established in this manner, this is illusionary.

The equity transfer involved in this case is a part of the related party transactions, Zeng Hanlin as the associated party in order to allow Guangdong Flying Dragon Group to go through assets restructuring, had paid a hefty sum in this backdoor listing. This proved that he had no intention to illegally possess the property of the other party. Evaluating the price paid by Guangdong Flying Dragon will need to take into consideration of the two contracts. Guangdong Flying Dragon Group injected its subsidiary company, Guangdong Flying Dragon High-speed Passenger Ferry, high quality asset worth more than RMB 100 million yuan into Chengdu Lianyi Industrial Co., Ltd. despite that Chengdu Lianyi Industrial Co. Ltd has not made any payment. Apart from the transfer of 75% stake to Chengdu Lianyi Industrial Co. Ltd, Guangdong Flying Dragon High-speed Passenger Ferry had even thrown in a full year of 1997 annual profit; this profit alone has already worth RMB 32.85 million yuan. An extra payment of RMB 2 million yuan in cash, another RMB 6 million ,all in all, a total of RMB 40.85 million yuan into the profit basket of Chengdu Lianyi Industrial Co. Ltd. As of 17 August 1998 when the Public Security Authority place the case on file for investigation and prosecution, Chengdu Lianyi Industrial Co. Ltd was supposed to pay to Guangdong High-speed Passenger Ferry the equity price of RMB 13 million yuan, but NOT a penny was paid while Guangdong Flying Dragon Group has fulfilled all milestone payment obligation in accordance with the contract clause. Apparently, it does not have the purpose of illegal possession, the facts have proven this.

(ii) Objective conclusion on defendant Zeng Hanlin defrauding the 40% stake in Chengdu Lianyi Industries Co., Ltd is totally illogical. Defining the loan of RMB 35 million yuan as an integral part of the contract fraud has no legal sense.

(a) Transposing the cause and effect, time and relationship, event chronological order that leads to a wrong conclusion. The first instance verdict determined that the defendant Zeng Hanlin fulfil a small part of the contract as a bait, instigating Zhang Zhaohui to fabricate false certificates of deposit, remittance documents and using other means to swindle Chengdu Lianyi Group RMB 68 million yuan worth of corporate shares. This reverse of the event chronological order, time and relationship is completely illogical. When Guangdong Flying Dragon Group acquire the 40% stake in Chengdu Lianyi Co., Ltd., the contract was signed on 15 October 1997. The false certificates of deposit and remittance certificate were issued on 10 December 1997 and 12 December 1997, the payment of the contract deposit of RMB 2 million yuan was done in 26 December 1997. In addition, Guangdong Flying Dragon Group has also paid to Chengdu Lianyi Group an amount of RMB 6 million yuan in September 1998. All these fraudulent pretences determined in the first instance verdict occurred after the signing of the first <Equity Transfer Agreement>. Thus, the recognition of these facts in the first instance verdict has completely reversed the order of the event chronological order, time and relationship, will definitely leads to a wrong conclusion, judgment error by the prosecutore is inevitable.

(b) Using fulfilment of a small part of the contract as a bail to deceive Chengdu Lianyi Group in continuing to honour the contract, this cannot be established. The first instance verdict determined that Guangdong Flying Dragon uses the plot of "fulfilling a small part of the contract as bait to trick Chengdu Lianyi Group in fulfilling the contract, as a matter of fact, this is not just fulfilment of a small part of the contract, but full payment performed periodically to fulfil its obligations by Guangdong Flying Dragon Group. After both parties had signed on the two <Equity Transfer Agreement>, Guangdong Flying Dragon Group has injected its subsidiary Guangdong Flying Dragon High-speed Passenger Ferry's 1997 whole year profit of RMB 32.85 million yuan into Chengdu Lianyi Industrial Co. Ltd, plus cash payments of RMB 8 million yuan, a totalled of RMB 40.85 million yuan. In accordance to the terms and conditions defined in the first <Equity Transfer Agreement>, before the Public Security Authority place the case on file for investigation and prosecution on 17 August 1998, the payment required from Guangdong Flying Dragon Group for the equity price happens to be only RMB 40 million yuan.

(4) Defining the loan of RMB 35 million yuan as an integral part of the contract fraud has no legal sense

The first instance verdict ascertained that "Guangdong Flying Group deceived Chengdu Lianyi Group into signing the Equity Transfer Agreement, and followed with fulfilling only a small part of the contract, producing false certificates of deposit and remittance documents and other means to trick the Chengdu Lianyi Group to continue performing its obligation on the contract, conning Chengdu Lianyi Group RMB 68 million worth of equity, using it as a security pledged for loans and occupying the loan for own use, this behaviour constitute a contract fraud and the defraud amount is extremely huge. Defendant Zeng Hanlin is the Chairman and General Manager of Flying Dragon Group, is the executive with direct responsibilities in the company and is therefore directly responsible for the crime in his unit, this behaviour constitute a crime of contract fraud." From this judgment, the first instance verdict obviously had ascertained the loan of RMB 35 million yuan as an integral part of the contract fraud. Such ascertainment is erroneous.

Firstly, Guangdong Flying Dragon Group did not sign the Equity Transfer Agreement for the loan. Even though Guangdong Flying Dragon Group had uses its 54.7456 million equity in Chengdu Lianyi Industrial Co. Ltd as a security pledged for loans of RMB 35 million but this was not its intention in acquiring the other 40% equity in the first place. The <Equity Transfer Agreement> was signed on 15 October 1997 while the loan of RMB 35 million yuan from Bank of Communications was obtained on 18 August 1998, the before and after of both incidents happened at an interval of 10 months apart. During this period of time, the financial statement from Guangdong Flying Dragon High-speed Passenger Ferry had been merged and consolidated with Chengdu Lianyi Group; its profit has been injected into Chengdu Lianyi Industrial Co., Ltd. as well. To take note, the 75% stake of Guangdong Flying Dragon High-speed Passenger Ferry had now belongs to Chengdu Lianyi Industrial Co. Ltd, although the changes have not been completed in the Administration for Industry & Commerce but the registration of changes had been approved by the SFC. The equity transfer does not consider the changes in the Administration of Industry & Commerce as a necessary element. Occupying the loan will not be the real intention of Guangdong Flying Dragon Group. The loan of RMB 35 million yuan was actually used to repay Guangdong Flying Dragon High-speed Passenger Ferry debts for the purchased of ships, docks, boat as well as for the company operation cost. In addition, there was a RMB 6 million yuan paid to Chengdu Lianyi Group. The distribution and usage of the money clearly illustrated that the real purpose of the loan was to create a multi-win-win situation; this kind of situation cannot be generated immediately during the signing of the Equity Transfer Agreement.

Secondly, identifying the loan amount as "illegal possession" is incorrect. Amount borrowed from the bank has to be returned upon the expiry of the loan terms with its principle amount and interest. The RMB 35 million yuan was put back into the company for use, as long as the interest was paid up, the borrower has the right to possess it. Borrower behaviour in the case of non-infringement of capital ownership, does not exhibit any element of contract fraud, it cannot constitute a crime. In this case, the defendant Zeng Hanlin did not use the whole or any part of the RMB 35 million yuan loan for personal possession, or taken abroad, or for personal splurge, or withhold without return; Guangdong Flying Dragon Group did not default the loan interest payment or exhibit a behaviour of intending not to pay the principle amount plus interest. Henceforth, there is no recognised behaviour of illegal possession or attempt to illegally occupy the RMB 35 million yuan by Guangdong Flying Group.

Therefore, the RMB 35 million yuan loan should not be considered as part of the integral part of the contract fraud.

Thirdly, the indirect fraud cannot be established. Using the defraud Chengdu Lianyi Group 40% equity and determining using the "defraud" 40% equity to pledge as security for the loan of RMB 35 million yuan is indirect fraud and constitute a contract fraud, this analysis cannot be established. There are two reasons to this: Firstly, the precondition is falsify, before Guangdong Flying Dragon Group transfer the 40% equity, no fraud was performed, the 40% equity was not acquired through fraudulent behaviour; Secondly, there is no exclusivity for such inference from the logic, the conclusion is inappropriate.

Fourthly, there is insufficient evidence to establish that Zeng Hanlin had committed contract fraud.

(1) Relevant authority was in accordance with procedures in disclosure of information and had never concealed any information to anyone. KPMG LLP is an accounting firm approved by the Ministry of Finance and China Securities Regulatory Commission, an establishment of Chinese-Foreign cooperative with audit qualification. Guangdong Asset Evaluation Company is a specialized agency of assessment approved by the State-owned Assets Administration Bureau and the China Securities Regulatory Commission to engage in securities business assets evaluation. Documents produced by the three institutions as mentioned above have legal effect. They produce documents to prove the following:

(i) When signing the Equity Transfer Agreement on 15 October 1997, <Audit Report> clearly documented in the 13 vessels collaterals conditions in 1996, 1997 and 1998; this <Audit Report> is an important document that Chengdu Lianyi Group has to peruse;

(ii) Guangdong Asset Evaluation Report issued on 18 December 1997 sets out the year ended 31 December 1996 that Guangdong Flying Dragon High-Speed Passenger Ferry contained a debt of RM 13.9808 million yuan, this document is a must-read document for Chengdu Lianyi Group when they entered into the Equity Transfer Agreement. Moreover, this document is openly published in the annual reports of the listed companies in 1997, there is no intention to conceal information and no one was unaware of this information.

(iii) <Assessment Report> issued by the Guangdong Kexin Certified Public Accounting firm on 18 March 1996 proved that as per the base date of 31 December 1995, Guangdong High-speed Passenger Ferry original face value of its fixed assets was worth a value of RMB 102,630,389 yuan, the evaluation value of assets is worth RMB 95,096,899 yuan, after assessment, the assess value of fixed assets are worth at RMB 100,014,399 yuan, evaluation variance show an increment of 5.17 percent. The capital verification report issued by Guangdong Kexing Certified Public Accounting firm on 3 July 1996 states that: As of 31 December 1995, Guangdong Flying Dragon High-speed Passenger Ferry total assets are worth RMB 107 million yuan, total liabilities of RMB 7.46 million yuan and net assets (equity) at RMB 99.62 million yuan, paid-up capital at RMB 99.6213184 million. These financial figures are the "must read" information when Chengdu Lianyi Group signed the <Equity Transfer Agreement>. This information was never concealed to anyone.

(2) The prosecutor modify the debt owing data right in the court, the previous accusation of hugh debt amount concluding the inability of Guangdong Flying Dragon Group not being able to honour the acquisition payment just fall apart. A total collapsed.

The first instance verdict determines the defendant "concealing the truth of the huge liabilities and inability to pay", but a clear explanation for the "huge debt" was never clearly defined. As per the prosecutor statement in court, in accordance with the confession of the defendant testimony of Li Kai ascertained that the total debt amount of the defendant at that time was RMB 120 million yuan, in accordance with the prosecutor immediate amendment in the court during the first instance trial was reduced to RMB 30 million yuan, in accordance to the Guangdong Assets Evaluation Report, the total liabilities was RMB 13.9808 million yuan, according to the audit report, the net assets was valued at RMB 108.5322 million yuan, regardless of whether the debt amount was RMB 30 million yuan or RMB 13.9808 million yuan, the company can never be in the insolvent state and no ability to pay. The First Instance hearing is based merely on the verbal testimony of Zhang Zhaohui and Li Kai to conclude that Guangdong Flying Dragon Group is in no position to make payment; there is no factual basis to be established. The prosecution judgement on Zhang Zhaohui 11 years ago was based on the precondition that the company debt amounted to RMB 120 million yuan and was in the state of insolvency. After 11 years, a further hearing on 17 November 2011, prosecutors had amended the debt amount in court from RMB 120 million yuan RMB 30 million yuan. This act has proven the testimony of Zhang Zhaohui, Li Kai, etc (Zhang Zhaohui testimony at then proved that the asset amount during the equity transfer of Guangdong Flying Dragon Group to be RMB 50 to 60 million; Li Kai testimony at then prove that during the equity transfer, the liabilities of Guangdong Flying Dragon Group to be RMB 120 million yuan, debt ratio was 200%) are fictitious, the testimony in the original trial at then from Zhang and Li are groundless and cannot be adopted. According to the rules of evidence, documentary evidence of proof are more effectiveness than oral evidence of proof, when two are in conflict, the documentary evidence shall be admissible. Therefore, the court should not recognised Zeng Hanlin as instigating a contract fraud.

(3) Solitary testimony is inadmissible. The First Instance trial produce evidence of false deposit slips, false remittance documents to deceive each other, towards this, Zeng Hanlin has never admitted to this accusation, the trial volume contains only the solitary testimony of Zhang Zhaohui, this is inadmissible.

(4) To force the defendant to bear the legal consequences dereliction of duty by the informants is unjustifiable.

Base solely on the claim of the informants that he is not aware of the RMB 35 million yuan loan from Guangdong Flying Dragon Group to determine the behaviour of defendant pledging the equity for loans of RMB 35 million yuan is a fraudulent act of contract fraud, this is baseless and lack of evidence of fact. In accordance with the provisions of law, to use a public company shares to be pledged as a security for loans, public notice has to be made, the Borrower had already made a public notice to the Shenzhen Stock Exchange in advance. This proved that the borrower Guangdong Flying Dragon Group and its legal representative Zeng Hanlin have no intention to conceal any information from the other party. The informant as the Vice Chairman of a listed company did not do his part to peruse the Exchange publicity documents is a strong case of dereliction of duty. The informant cannot use his dereliction of duty as a reason to seek legal compensation from the other party. Therefore, Zeng Hanlin's borrowing behaviour cannot constitute a contract fraud.

Illustration of the related party relationship between Guangdong Flying Dragon and Chengdu Lianyi:

The 21 Legal Professionals and Law Professors unanimously concluded that Zeng Hanlin is NOT guilty of “Contract Fraud”, it is merely a “Civil Matter”. Their signature as attached:

Click on the link to view the video of the panel discussion: http://youtu.be/WRI36uVzg1A